Holiday spending

The holiday season is upon us, and for many, that can mean feeling stressed and financially strained. Saving money during the holidays can be tricky, so control your...

Why you need a motor warranty

There is always a chance that your car is going to suffer a mechanical breakdown of some sorts. Insure you have a motor warranty for the holidays. At...

Types of Car Insurance

The vehicle owner needs to be aware of the types of car insurance options. There are several different types of car insurance available on the market today. Each...

Should you consider a personal loan for the holidays

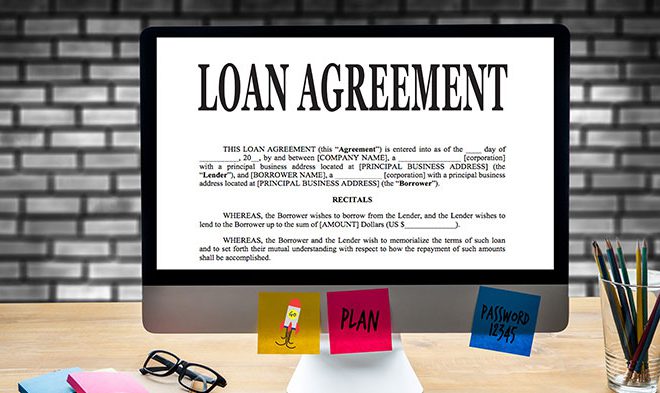

Should you consider a personal loan for the holidays? With the holidays and festive season fast approaching, you may be wondering how you are going to pay for...

How to save on your holiday shopping this festive season

It may only be the second week of November, but by now you’re probably getting quite worried about how much December is going to cost you. Prices of...

Complimentary R25 000 accidental death cover

Get R25 000 worth of accidental death cover at no cost to you. MoneyShop, together with AllLife would like to offer you R25,000 of accidental death cover at absolutely...

Car insurance before driving on holiday

Car insurance before driving on holiday. Are you planning your next drive to a holiday destination? Who does not love a good road trip to their favourite local...

Home cover when away

Home cover when away is very important. As well as insuring the items you’re leaving behind. You should also consider covering those you’ll carry with you on your...

Insurance for your home

Insurance for your home. When you buy a house, the bank will request that you take out a comprehensive homeowners insurance policy to the value of your home....

Is life insurance important?

Is life insurance important? Life insurance is often an underrated product. Mostly because we don’t like to think about death, and more than probably because we tend to...

Tips for Taking out Personal Loans

Tips for Taking out Personal Loans. A personal loan can be a very helpful way of getting finance when you really need it, but you need to make...

Consider this when taking a loan

Consider this when taking a loan. Personal loans can be a very dangerous path, leading you into a cycle of debt that can be difficult to get out...

Debt review can change your life

Debt review can change your life. It can help you organise your debt and structure payment plans that are manageable and achievable. Starting the process of debt review...

Ways a personal loan can help

Personal loans are commonly used to cover unexpected expenses, but they also offer another benefit. You can use the loan proceeds to help keep more of your hard-earned...

Is debt review a wise choice?

Is debt review a wise choice? If you find you are in a suffocating financial situation, then this is a question more than likely in the back of...

Is it important to have funeral insurance?

Is it important to have funeral insurance? Although death is a reality for all of us, a funeral is typically not a planned event. If you would like...

What affects your home insurance?

Ever thought about what affects your home insurance? Home insurance is like your spare tyre. You could go without it, but is it wise? So, even thou you...

How to debunk debt review

How do you debunk debt review? Some interesting myths busted. It is Saturday afternoon, you and a couple of buddies are relaxing around the braai, enjoying a pint...

Is Credit Good or Bad?

To understand credit, we need to go back at least 5 000 years to a time when it never existed. It was around then that Mesopotamia introduced something...

Have you considered Debt Review

Consider debt review it is a good option. What if you simply do not have enough money at the end of the month to service your debt? What...

MoneyShop RealSure Survey

Take part in our MoneyShop RealSure survey & win one of five R1000 Woolworths shopping vouchers. It should take no more than 3-4 minutes. There are no right...

Why is a personal loan good for you?

A personal loan can be very beneficial. Borrowing a lump sum to meet financial needs and paying it off in instalments is seen as a great way to...

Review: MoneyShop MoneyBot

We have launched our MoneyShop MoneyBot. Take a look at our whatsapp review. WhatsApp is undoubtedly one of the most popular messaging apps As an internet user, it...

Financial focus in 2022

Finding financial focus in 2022 is going to bring you peace of mind and more money. If you found yourself going a bit off track with your money...

Money tip – Back to school saving

Back to School is always an expensive time for parents. Many children will have had growth spurts, not to mention who knows where all the stationery has ended...

Money tip – Shop smart

Shop smart, easier said than done. You have to be really disciplined and patient, wait till you can. Try turn the “I want” into later “when I can.”...

How to – Save for rainy days

Make savings part of your monthly budget So, you want to save for rainy days. If you wait to put money aside for when you consistently have enough...

How to – Save correctly for retirement

Start saving asap One needs to save correctly for retirement. Not next week or when you get a raise or even only next year. Today. Because money you...

Money tip – Up your earning potential

The new year is almost upon us, time to think about how you can up your earning potential. Earning potential will allow you more financial freedom. When negotiating...

Life insurance questions you should ask

You're in the market for life insurance, nobody really wants to talk about life insurance, it sounds expensive and brings to mind our own mortality. However, having the...

How to – Get money motivated

Draft a financial vision board You need to be money motivated to start adopting better money habits, and if you craft a vision board, it can help remind...

How to – Budget Like a pro

Set a budget period This is the starting point for every other goal in your life. Setting up a budget plan is the foundation of your finances. Above...

Money tip – What Is the 50/20/30 Budget Rule?

The 50/20/30 budget rule is an intuitive and simple plan to help people reach their financial goals. The rule states that you should spend up to 50% of...

Money tip – A Few Financial Basics

Here are a few financial basics which one should always be considering in order to maintain a healthy financial status. Create a Financial Calendar If you don’t trust...

Home insurance

A house brings with it a wealth of additional responsibilities, including practical matters such as maintenance and home insurance. There is no point in making this type of...

Car insurance

Imagine for just a moment that you didn't have your car because it was at the mechanic due to a horrid accident. You would have to depend on...

Funeral cover

Having funeral cover in place is important to cushion yourself financially during a very tough time. While funeral cover can never ease the pain of your loss, it...

Life cover

Life cover isn’t always a priority in the budget. “I know I need life cover, but I cannot afford it” Does that sound familiar? Finding ways to free...

Insurance Series: Self insurance, a discussion

How does one think about insurance? Personally, I see insurance as a bit like a game of chance with a bunch of data to help stack the odds....

Review: Tax Tim

Have you ever sat in the waiting room at SARS? Well, I have, and it’s not recommended. I decided to use an online self-service option called Tax Tim....

Money tip – Financial education

The financial education category lists personal finance tips that can help you learn more about money. Read personal finance books If you don’t know where to start with...

Money tip – Behavioural finance

The behavioural finance category lists personal finance tips that can help you understand money more deeply. And how your beliefs and values affect your behaviour toward money. Own...

Insurance Series: You may be paying too much for your vehicle insurance

Vehicles lose value every year, regardless of condition or mileage. You may be paying too much for your vehicle insurance. Mead & McGrouther and TransUnion HPI, who have...

How to: Get a retirement investment report from MoneyShop

Ever wondered how you can get a investment report from MoneyShop? Follow the how to steps below, it is simple, quick and easy. Investing is important for your...

Service Quality & Customer Satisfaction Survey Results

MoneyShop Service Quality and Customer Satisfaction Survey Results are here. In our recent survey we asked numerous questions regards your banks service quality and your satisfaction with your...

What does written off debt mean?

Ever wondered about written off debt and how many years it would take for debt to be written off? Prescribed debt is old debt that has not been...

Save on your car insurance

To save money on your car insurance is one thing most people would really like to do. One needs to know what to do to save money in...

Review: Buying life Insurance review Hippo

It is hard to say exactly why buying life insurance is such a difficult decision for some people. The question I get asked the most is “how do...

You need a loan, why? A reason to take a personal loan

There are many, a good reason to take a personal loan. Including consolidating costly credit card balances and financing weddings or once-in-a-lifetime trips. Often most useful for less...

Fortune favours the prepared

As they say "Fortune favours the prepared" It’s better to be in control of when and how much money you need to borrow rather than being unprepared and...

Money tip – People

On to the most challenging category – people. Ha. Money and people – the dreaded money fight – we’ve all been there. So, this category lists personal finance...

Money tip – Minimalism

Minimalism is all about living a more fulfilling, simpler life. It’s about living with less stuff and having more meaning. It’s about people, experiences, and purging all your...

Review: Try the FNB Virtual card

Try the FNB Virtual card solution. I have had some bad luck in the past concerning my bank cards. Miss placing them or 8/10 times bank teller machine...

How to: Get insurance quotes from MoneyShop

Ever wondered how you can get insurance quotes from MoneyShop? Follow the steps below, it is simple, quick and easy… Go to the Insure tab, click on Insurance...

Tax Series: Claim for your office at home

Working @ home? You may be able to claim expenses Claim for your office at home. It has been more than a year now since the start of...

4 Benefits of home insurance

Many people look at the benefits of home insurance as an option, but in reality, it should be a necessity. The benefits of home insurance will not only...

Should you switch your medical aid?

Thinking of changing your medical aid? Before you switch medical aid plan, or downgrade to a cheaper option, there are a few things to consider… Cancellation terms Be...

MoneyShop Bank Physical Environment Survey Results

Bank Physical Environment Survey Results are here. In our recent MoneyShop Bank Survey we asked you to rate your banks physical environment? Physical Environment, how important is it?...

How can I pay off my debts?

The first step in paying off your debts is to get really clear on exactly what you owe (and to whom). This will give you a total picture...

Borrowing from or lending to family or friends

Do you borrow or lend to family or friends? It can be tempting to ask friends or relatives to lend you money. But you need to think carefully...

Money tip – Giving

Giving, this is a bit different because it focuses on letting go your money (not on using your money for your own benefit). Giving is a big part...

Money tip – Frugal living

Frugal living can help you live below your means and accomplish your goals (great if you are strapped for cash or getting out of debt). Never buy something...

How to: Apply for a loan from MoneyShop

Ever wondered how you can apply for a loan from MoneyShop? Follow the steps below, it is simple, quick and easy… Click on Borrow. Go to the Borrow...

Tax Series: Why Tax Free Savings

If you are new to savings and investment and you do not already have a Tax-Free savings account, then this is probably something you should consider. What does...

Service Quality and Customer Satisfaction Survey

MoneyShop is conducting a survey to assess the service quality of SA Banks. Survey Description The effect of service quality and customer satisfaction on brand association within the...

Is there a maximum and minimum loan period?

If you are in need of extra cash, you may be considering applying for a loan. Is there a maximum and minimum loan period? If you have never...

How big can your personal loan be?

The amount you can borrow for a personal loan depends on the lender. As well as your salary, credit score, and outstanding debt. Each lender has a different...

What does pre-qualification for a loan mean?

Pre-qualification for a loan: If you have been approached by a loan provider, this may indicate that you have already pre-qualified for a personal loan. In the...

Life vs funeral insurance cover

One of the most common insurance conundrums is choosing: Life vs funeral insurance cover. Insurance experts say that it depends on your needs. If your family needs financial...

Funeral Cover Series: Different expenses linked to a funeral

Planning a funeral comes with a long checklist, but being prepared allows you or your family to select a funeral home that will be able to assist you...

Money tip – Spending

This section lists personal finance tips that can help you with your spending. Live below your means Whether you are rich or broke, it is wise to live...

MoneyShop Bank Physical Environment Quality Survey

Physical Environment, how important is it? Many research studies have highlighted the importance of a company’s physical environment on a customer’s overall evaluation of service quality. The physical...

Money tip – Investing

The investing category lists personal finance tips that can help you with investing. Start investing in a personal investment account after you have maxed out your retirement accounts...

Tax Series: Tax returns

It is smart to do your tax returns, but to use that to your advantage is clever! I did not know that I could get excited about tax,...

MoneyShop Bank Interaction Survey Results

MoneyShop Bank Interaction Survey Results are in. In our recent MoneyShop Survey we asked, How is your banks service interaction quality? Our results are in, please see the...

Options for retirement

Pension fund, provident fund or retirement annuity. What are the different savings options for retirement, and which is right for you? Pension fund vs provident fund vs retirement annuity...

Car Insurance or Motor Warranty?

The two most common plans are Car Insurance and a Motor Warranty. The first is offered by insurance companies and the latter by the vehicle manufacturer. Sometimes insurance...

Money tip – Retirement savings

The retirement savings category lists personal finance tips that can help you with saving for retirement. Do not put off saving for retirement Start saving for retirement as...

Money tip – Liquid savings

The liquid savings category lists personal finance tips that can help you save money. Pay yourself first When you are trying to save money, practice saving money right...

Borrow wisely

Money can solve a lot of problems. Sometimes it makes sense to borrow money for things that will improve your life over the long-term. But money can also...

Funeral Cover Series: The average cost of a funeral in South Africa

Funeral cover cost is important. No one is truly ever prepared for death, not for your own of for the passing of someone you love. The fact is...

MoneyShop Bank Survey, Measures Service Interaction Quality

As competition and disruption grow in the financial market, it is now, more than ever, important for banks to understand what their customer expectations are so they can...

How banking has changed

Banking has been in existence for thousands of years. Over the years generational shifts, behavioural changes and the digital revolution have brought changes to the industry. Significantly altering...

“Gap Cover” What is it?

What is “Gap cover”? While you may have some form of medical aid plan, depending on its structure, more often than not the scheme will not cover all...

MoneyShop Banking Survey Results

In our recent MoneyShop Banking Survey we asked various questions because we want to better understand what you think about your bank. Our results are in, please see...

Cutting through the clutter: Why life cover matters

Cutting through the clutter: Why life cover matters. Cost. Culture. Confusion. These are the three main reasons why the vast majority of South Africans are either underinsured or...

Be informed before taking a loan

Be informed before taking a loan. Taking a loan can have a positive impact on your credit score and finances (if used responsibly). So it is worth taking...

Why having credit cards can be good for your credit profile?

When used responsibly, credit cards can be a powerful financial tool that will assist you to build a good credit score which in return might mean you can...

MoneyShop Bank Survey

Can you believe we are almost at the end of the first quarter? Please complete our survey so we can better understand what you think about your bank....

Estate planning

Planning for your death and thereafter is never nice but, like tax, is just part of life. Making sure that your family and other loved ones, but also...

Money tip – Debt

The debt category lists personal finance tips that can help you with debt. Get out of debt One of the best personal finance tips is to get out...

Money tip – Career

On to career. The career category lists personal finance tips that can help you with your career. Work in a job that pays you what you are worth...

Our children will inherit debt

Some really interesting reading found on the web… The opposition Democratic Alliance has launched its ‘alternative budget’, highlighting the major debt problem currently facing South Africa’s fiscus. The...

How to give your child the best education

Every parent wants to offer their child the best education possible, but school and university fees are extremely high meaning that you may not be able to afford...

Money tip – Income

Increase your income by doing something meaningful. Make money doing something that fulfils you Pursue making money doing something that fulfils you. Whether that’s in the career you’re...

Money tip – Money Management

Personal finance tips that can help you manage your money better. Create a budget Create a budget based on your monthly income and expenses. A budget is the...

Should you pay your creditors directly while under debt counselling?

Sometimes consumers try to pay their creditors themselves because they’re trying to avoid paying the Payment Distribution Agent (PDA) fees for distribution, says Awie Coetzee, a debt counsellor...

Your rights regarding debt

Debt if not managed properly can ruin your life. For many one of the first red flags is usually receiving countless calls from creditors and debt collection agencies....

You can emigrate, but you can’t escape your debt

If you are burdened with debt, you might have considered going overseas and leaving your baggage of debt behind. Some people hope that their debt will then somehow...

Options for debt relief – Debt counselling vs debt consolidation

We break down two of the ways that can help you clear debt. Consolidate your debt A debt consolidation loan is a powerful tool that helps to simplify...

No more cashing of cheques

The South African Reserve Bank announced that cheques will not be supported by the country’s national payment system from 1 January2021. The Bank, which is ultimately responsible for...

5 Ways to Cut Spending

It's often the smaller things that add up to huge costs over time - stopping the smaller costs may amount to significant savings in the long run. Here...

What’s your most important asset in 2021?

Most people's answer to this question would be their beautiful home or the set of wheels parked in their driveway, but hands down, your greatest asset is, in...

Use your TFSA to take care of all those 2021 savings goals

"Roy?" "Yes?" Roy replies as he puts down the Sunday newspaper and peers at his wife over his spectacles. "Don't you think our bathroom is starting to look...

The question for 2021 is “What if?”

Living with your family 24/7 for a good few months last year was interesting, wasn't it? Within the confounds of our shelters, we all hunkered down stockpiled and...

The Most Important Question You Can Ask Yourself In This Decade

Almost twenty one years ago we waited with bated breath for the Y2K bug to paralyze every computer around the globe and plunge us back into the dark...

4 Types Of Investment Funds You Can Start Thinking About This January

It sounds like a bit of a cliché, but times are still very tough for millions of people across our country. Presently, South African consumers owe a staggering...

Springboard Into 2021 With These 28 Money Saving Strategies

Hopefully this article finds you chilling under a candy stripped umbrella somewhere on a sandy South African beach. And if that isn’t the way you are spending your...

New year, new you – make 2021 the best financial year yet

New Year’s resolutions are so last year… Let’s face it, most people don’t stick to them anyway. Which is why we have resolved to not set ourselves up...

Will Any Insurer Be Prepared To Cover Your Household Goods Over The Christmas Period?

It’s almost holiday time and in a few weeks millions of South Africans will be off on their annual migration to different parts for our country for a...

Overdraft facility explained

Having your card transaction declined when you are making a purchase can be embarrassing. Being penalised for having insufficient funds in your account is even worse. However, banks...

Debt Trapped South Africans Have These 3 Options Available To Them

Even if you don’t buy into all the mainstream New Year’s resolution hype, you can’t deny the fact that there is a moment (sometimes just a fleeting moment)...

Do’s and don’ts when you’re over-indebted

Having too much debt can keep you from reaching your financial goals. This is why you need to manage your money wisely to ensure that this does not...

What should you do if you get a final Letter Of Demand?

Stick up your hand if you have a few credit agreements in place? Now stick up your other hand if you’ve fallen behind with some of your debt...

What Should I Do With My 13th Cheque This Year?

It’s the home stretch, and there are only a couple of weeks left in this year. For many of us, the next few weeks represent a time to...

What’s The Difference Between A Bonus And A 13th Cheque?

If the year was a stage play, this period might well be considered “the final act.” As the curtain draws, many of us will be looking towards the...

4 money lesson COVID-19 has taught us

Wow, what a year it’s been… Only a Hollywood Director could dream up a “Doomsday” plot about a virus that pops out of a wet market in a...

No Discovery Health medical aid increases for the first six months of 2021!

No Discovery Health medical aid increases for the first six months of 2021! If you belong to a South African medical scheme, the odds are you have a...

MoneyShop Youth Month Survey

June was Youth Month. And so we took a look at how a parents finances affect their children. Some key items to take away: More than half of...

What does the all-time low repo rate mean for you?

What does the all-time low repo rate mean for you? The South African repo rate currently sits at 3,5% - the lowest in over 20 years. How does...

Does it hurt my credit profile when I check my credit score?

We have heard this question often: “Does it hurt my credit profile when I check my credit score?” When a bank or lender carries out a hard search...

MoneyShop Credit Health Report

This report has been compiled using credit report data of clients who applied for credit via the MoneyShop platform between October 2019 and September 2020. Over 1m records...

SARS Auto Assessment

Did you receive an SMS from SARS a little while ago? Still in your inbox? SARS recently sent out an SMS to taxpayers about 'auto-assessed' tax returns. If...

Review: Sixty 60 Grocery App Checkers

Lockdown rules have eased, and South Africans can now move around a bit more freely. Although we have more flexibility when it comes to grocery shopping, going to...

All you need to know about a Tax Free Saving Account

So you’ve heard the adverts on the radio, but is it true? Can you really save money and then withdraw it tax-free? Are you eligible? If you are, how...

MoneyShop Savings Survey

Spring is in the air! It is a new month, it is a new season! Please complete our survey so we can better understand how you save, and...

The impact the Coronavirus has had on Rainbow Nationers

Jeez, this year has been a rollercoaster ride, hasn't it? Fingers crossed we've broken the back of COVID, and as we transition from a super-chilly and dreary winter...

Tips on how to pay less tax next year

Your 2021 tax return. Considering how 2020 has turned out, everyone is trying to save money wherever they possibly can. With this in mind, we’re going to provide...

Review: British Airways Credit Card

I really love the British Airways Avios reward programme, so I’ve always been looking for the best way to earn Avios via my credit card spend. Discovery Platinum...

What is a Credit Bureau?

A credit bureau is a company, registered by the National Credit Regulator, that has the right to both store and selectively sell your credit data. A credit bureau...

Review: Avo App Nedbank

Did you know that in South Africa about 1kg of avocados is consumed per person per year? Whether you top your toast with avocado at breakfast, serve it...

5 warning signs you might be ready to have a chat about Debt Review

With this COVID-19 pandemic still looming over everyone’s heads, and the fact that many businesses are struggling to stay open, the reality is that many South Africans are...

Review Discovery Bank

There’s a saying...if it’s not broken, why fix it? This is ALMOST true with the new Discovery Bank product. In 2019 Discovery ended their partnership with FNB and...

How to move your side-hustle idea forward

After hours of thinking up ideas and dreaming about your side gig, you may be feeling pretty convinced that your plan is going to work and that you’ll...

What is the Envelope System?

As per my introduction in my previous article (My experience in offshore investing), coming from Zimbabwe meant that times where tough and we had to think of many…

South Africa’s Top 6 Savings Accounts (from the top 6 SA banks)

Most of us are under immense financial pressure and recent statistics have shown that South Africans are among the worst savers in the world. As a way to...

Can’t afford your rent? Don’t worry, just don’t pay

“Can’t afford your rent? Don’t worry, just don’t pay” is just about the worst advice someone could give you. But incredibly, with Coronavirus and the lockdown, this sort...

How do I improve my credit score?

Your credit score is one of your most important financial assets - maintaining a good score will enable you to have a good financial life. But what if...

75% of South Africans have lost income due to Covid-19 and the poor are the hardest hit

We recently ran a survey to get a better view of how South Africans have been financially affected by the Covid-19 Lockdown, and the results were distressing to...

Review Discovery Vitality Rewards Program

Consumers, myself in particular, are naturally sceptical of reward programs. Each brand is faced with trying to create a loyalty program that is different and competitive enough in...

Shake off the COVID blues and get your side-hustle going

We recently ran a survey to gauge the impact COVID-19 has been having on South Africans’ livelihoods. More than 1000 of our loyal MoneyShop subscribers participated, and it...

Review: InstantLife Insurance

After spending six years living in the UK, I returned home to South Africa to live in 2009. In the UK, buying insurance online was mainstream – nearly...

Am I blacklisted? What can I do to fix this?

There is this general idea held by consumers that if you don’t pay your bills, you can become ‘blacklisted’. In reality there is actually no such thing as...

MoneyShop Youth Month Survey

June was Youth Month. And so we took a look at how a parents finances affect their children. The results are in, please see the results below. Also,...

How do I read a credit report?

If you’re reading this, then you know that both your credit report and credit score are important. How do you read a credit report unless you are a...

My experience in offshore investing

I’ve always been a big believer in investing a portion of my earnings offshore, mainly because I was born in Zimbabwe and I’ve seen many families (including my...

Review: Simply Life Insurance – Domestic Worker Cover

Nannies and domestic staff are such important members of our families. From helping raise our kids as we head to work, to assisting with cleaning, cooking and other...

How Discovery Health Can Help You During Lockdown

This virus, and the lockdown that seems to be dragging its heels, have completely altered our way of living and for many of us, it’s severely affected our...

Are you Aware of the Tax you’ll Pay on your Severance Package if you Get Retrenched?

Let’s get straight into some of the financial implications of Covid-19: Economists are predicting that anywhere between 350 000 and 1 million people in South Africa could lose their...

Jobless with Loans to Pay? Check if your Credit Life Policy includes Retrenchment Cover

Now that the nationwide lockdown restrictions have been eased from phase 5 to phase 4, some of us will be able to go back to work. The reality,...

MoneyShop ‘Covid-19 and Your Finances’ Survey

There is no doubt that Covid-19 and the lock-down is destroying our economy. And some people in particular are being hit hard. Our survey for this month looks...

Want to reduce your car insurance premiums during lockdown? This is what happened when I did.

As uncertainty looms and questions clutter our minds about how to cope during the global Covid-19 crisis, consumers are looking at different ways to save money. One way...

Should you ask your bank for a payment holiday? I did! This is what happened

Level 5 of the National Lockdown may be over, but we still have a long road ahead. During this uncertain time, many people have lost their jobs, and...

Why is my credit score important?

A credit score is a very powerful piece of information. It is a single number, linked to your personal South African ID number, which is quite possibly the...

What is my credit report and how is it different to a credit score?

A credit report and a credit score are often used interchangeably. But, while they are related and you get both from a credit bureau, they are actually two...

What is a credit score and how does it work?

Your credit score is a single number (usually out of 1000) linked to your South African ID number, which represents how likely you are to repay your credit...

Is your bank going to give you a “payment holiday” during this pandemic?

This is the burning question in the minds of millions of South Africans right now. The answer? It depends. But what exactly does it depend on? Your payment...

Need to attend a funeral? But what about the COVID-19 lockdown?

At the time of writing this blog post, we are all still holding our collective breathes, aren’t we? Will the lockdown end, or will Government enforce further “stay-at-home”...

Can you take out life cover during this COVID-19 crisis?

Fingers crossed this self-isolation strategy takes the sting out of the rampant COVID-19 virus and more carefree days are not too far off. It’s going to be a...

COVID-19 will ultimately blow over, but will your debt woes?

Nobody saw the Coronavirus coming, and hopefully in a few months from now we might be able to start living a normal life again. Business is going to...

Was a credit assessment completed when you applied for a loan?

Have you recently applied for a personal loan or a credit card? Perhaps it was a different credit agreement altogether, like a retail clothing account or a payday...

5 money-saving strategies you can implement in tough times like these

South Africa is officially in a recession, and Coronavirus could end up affecting every aspect of our lives in the coming months. 2020 is shaping up to be...

3 Money Management Tips For Your 40s

40 – Is it the dawn of middle age or simply just a number? One thing is for sure, when you move into your fourth decade on this...

9 Things You Need To Understand About The 2020 Budget Speech

Since Tito delivered his budget speech a few weeks ago, a lot of numbers and percentages have been flying around in the media. It can all be a...

Married COP? It Has Real Ramifications When It Comes To Your Debt Review Application

Let’s quickly explain what it means to be married in Community of Property (COP): Firstly, this is the most affordable way to get married (because you won’t need...

It’s an Admin Hack But DebiCheck Is Here To Protect Us From Unscrupulous Marketers

The day our monthly debit orders run off our bank account leaves most of us feeling super-distressed. It takes at least 160 hours a month to earn our...

How you can apply for a personal loan via our website

An article in the Business Report section of www.iol.co.za, published on the 3rd December 2019, wrote that in the latest Consumer Default Index (CDI), released by Experian South...

What’s the difference between a Medical Aid Plan and Medical Insurance?

Whichever way you look at it, you simply can’t afford not to have some form of medical cover in place if you live in South Africa. The state...

Serious About Saving For Your Kid’s Education? – Here Are 3 Easy Steps To Follow

It costs a lot of money to send your kids to school. It costs even more to send them to University. But you know this already, so we’ve...

3 Personal Finance Questions Every 30-Year Old Should Be Asking Themselves

In our previous article last year, we talked about the top money questions every 20-year should be asking themselves. In this follow-up piece, we’ll take specific aim at...

What can you do if you are single parent and battling to get financial assistance from your Ex?

What can you do if you are single parent and battling to get financial assistance from your Ex? Are you a single parent due to a divorce or...

4 Types Of Investment Funds You Can Start Thinking About This January

It sounds like a bit of a cliché, but times are still very tough for millions of people across our country. Presently, South African consumers owe a staggering...

Have Your Say About Land Expropriation Without Compensation Before It’s Too Late

The government is planning on changing the constitution to allow for land expropriation without compensation. This is a drastic move and will guarantee that your money will be...

Springboard Into A New Decade With These 28 Money Saving Strategies

Hopefully this article finds you chilling under a candy stripped umbrella somewhere on a sandy South African beach. And if that isn’t the way you are spending your...

The Most Important Question You Can Ask Yourself This Decade

Almost twenty years ago we waited with bated breath for the Y2K bug to paralyze every computer around the globe and plunge us back into the dark ages...

What Should I Do With My 13th Cheque This Year?

It’s the home stretch, and there are only a couple of weeks left in this decade. For many of us, the next few weeks represent a time to...

Debt Trapped South Africans Have These 3 Options Available To Them

Even if you don’t buy into all the mainstream New Year’s resolution hype, you can’t deny the fact that there is a moment (sometimes just a fleeting moment)...

Will Any Insurer Be Prepared To Cover Your Household Goods Over The Christmas Period?

It’s almost holiday time and in a few weeks millions of South Africans will be off on their annual migration to different parts for our country for a...

Black Friday – 5 Signs That You Might Be Suffering From A Disorder Called CBD

It’s estimated that a staggering 42% of South Africans are planning to shop this Black Friday, which means billions of retail Rands will disappear from South African consumers’...

How Much Of Your Salary Should Be Going Towards Paying Back Credit Agreements?

Receiving your salary into your bank account at the end of the month is like introducing an ice cream cake at a nursery school party. Let’s just say...

What Your Public Credit Profile Score Will Tell You?

Our Free MoneyShop Credit report provides you with a number of great insights. One of those insights is your Public Credit Profile which is made up of 3...

MoneyShop Credit Score – We Can Tell You If Your Credit Application Is Going To Be Successful Or Not!

There literally could be thousands of reasons why you might consider applying for credit - anything from buying your dream house, that’s a few roads down from where...

People Like You Are Seriously Considering Products Like These

What’s the first thing we do when we are considering buying a new book, taking a holiday or even enjoying a meal out at a new restaurant? We...

What’s The Difference Between A Bonus And A 13th Cheque?

If the year was a stage play, this period might well be considered “the final act.” As the curtain draws, many of us will be looking towards the...

Can You Even Buy Retrenchment Cover Nowadays?

When the economy stutters, businesses feel the heat, and job losses are inevitable! A recent article published on the Business Tech website summarises the CCMA’s annual report for...

Will SARS Take A Healthy Chunk Of My Life Insurance Pay Out?

Life insurance isn’t something you get all warm and fuzzy about, is it? We all pay our premiums diligently, every month, and if some ill feeling or resentment...

How Do I Pick The Right Medical Aid Plan Option For 2020?

It’s about this time of the year that medical schemes across the country start rolling out their 2020 plan options. The one thing you can guarantee is that...

The Top 4 Money Questions You Should Be Asking Yourself In Your 20s

Fresh out of varsity or college and into that first job you’ve busted a gut to get? Now that the pay cheques are finally starting to roll in,...

Find Out What A 1000 South Africans Told Us About Their Relationship With Credit

We recently surveyed a thousand South Africans (well 1195 to be exact) and asked them a few personal questions about how they are handling their credit agreements in...

Discovery Bank – What’s All The Fuss About?

Let’s be honest, we don’t get much back from our banks, do we? Instead we cough up exorbitant monthly bank charges and seldom move because of the real...

Get your free credit report and understand what it means

Get a free credit report with MoneyShop today! You’ve probably heard about or seen the ads on TV positioning a credit report and why you should know what...

What Is A Life Insurance ‘Loading’ And When Can It Be Removed?

You often hear salespeople in the life insurance industry harp on about getting life cover when you are young because you will never be more youthful and healthier...

Will The New Debt Relief Bill Allow Me To Completely Write Off My Existing Debt? 14 Points To Consider

It’s done and dusted! President Cyril Ramaphosa has signed the National Credit Amendment Bill (the Debt Relief Bill) which could help thousands of South Africans completely write off...

Will My Life Cover Policy Still Pay Out If I Don’t Go For The HIV Test?

Did you know that if you pick up your cellphone and take life cover out with a direct insurer, they aren’t going to ask you to go for...

Can’t I Just Take Out A Bunch Of Funeral Plans Rather Than One Life Insurance Policy?

Sure, you can. In fact, there is no restriction on how many funeral policies you can take out. If you want R50 000 funeral cover from ten different South...

The Maximum Amount Of Interest You Can Be Charged On Your Personal Loan?

Desperate times often call for desperate measures. A recent Consumer Credit Market Report released by the National Credit Regulator indicated that a staggering 10,75 million credit applications were...

Investing in Tax-Free Investments when returns seem flat

So, you’ve been investing in your tax-free investment for the past few years and it seems as if nothing is happening. The only growth you can see is...

Can you invest in a Retirement Annuity if you only have R300 a month to invest?

Picture it - no more need for that alarm clock, no rush hour traffic to deal with, no KPIs or deadlines to meet, and no boss to answer...

Tax You Will Soon Have To Pay SARS If You Are Working Overseas

Storm clouds are brewing for South African residents who are working abroad. If that happens to be you, then make a mental note of the following date –...

What should you do if you get a final Letter Of Demand?

Stick up your hand if you have a few credit agreements in place? Now stick up your other hand if you’ve fallen behind with some of your debt...

How much life cover can you get for R300 per month?

Life insurance is one of those purchases most of us will end up making at some point in our adult life. You certainly aren’t thinking about the implications...

What type of retrenchment benefit can you expect, and will it be taxed?

The unemployment rate in South Africa is sitting just below 30%. That’s a staggering statistic and the highest jobless rate since the first quarter of 2003. And if...

How much will I be taxed if I withdraw my pension fund monies?

It’s estimated that before you reach the age of forty, you might already be into your 10th job! By the time you contemplate retirement, that figure will probably...

How Much Money Do I Need To Save Every Month To Retire On R20 000 pm?

At some point everyone reading this blog post would like to put their feet up and stop working altogether. The big question is how much do you need...

You Have The Right To Know Why Your Credit Application Was Refused

The thing about “consumer rights” is that most consumers aren’t even aware of them! In fact, there are several pieces of consumer-focused South African legislation that have been...

Find Out Why It’s Smart To Set Your Young Kids Up As “Trust Fund Babies”

When you hear the term “trust fund baby” it conjures up images of young rich kids, lying around on super-yachts sipping expensive cocktails they don’t even know the...

Feel Like You’ve Been “Duped” Into Signing A Credit Agreement?

“Just sign here and here and remember to initial on each page” mutters the salesman who clearly seems unimpressed that he couldn’t switch out his Saturday morning shift....

Do I Need Critical Illness Cover If I Belong To A Medical Aid?

When most of us think about life cover, we don’t necessarily think about the two additional benefits we can bolt onto our policy (disability and critical illness cover)....

Ways You Can Spot A Personal Loan Email Scam

If you have an email address, you probably get a bunch of promotional mail delivered to your inbox every day. It’s a bit like post you receive in...

It’s illegal for credit bureaus to hold this information on you

A credit bureau report (which BTW is free once a year) is important for consumers to access because it might contain negative information which could influence interest rates...

How much money can I legally ship out of South Africa each year?

The elections have come and gone, and just recently we had the news that our economy posted the worst growth figures in a decade. There is a sense...

Can I transfer my group life cover if I leave my company?

You’ve had enough. Enough of the daily commute, the office politics, and you’re frustrated that you still haven’t ‘cracked the nod’ for the corner office. It’s time for...

What’s the difference between a Payday and a Personal Loan?

You’ve finally decided to get into shape because your current shape is completely unrecognisable. That New Year’s resolution list, you knocked out on the beach 5-months ago (with...

How much can I be charged when I take out a loan?

There always seems to be far more month than money left in your bank account, and unless you can miraculously cash in on the Lotto Powerball ticket, pinned...

What exactly is a credit bureau?

Put up your hand (nobody is watching), if you’ve ever been in the following situation? On a whim, you’ve decided to apply for “credit”, a store clothing account...

The web is full of unscrupulous marketers looking to cash in on your “I need a loan” Google searches

You are tossing and turning like a load of laundry in a quick wash cycle. As you roll over, your digital bedside clock reaffirms what you already know...

Overdraft facility explained

Having your card transaction declined when you are making a purchase can be embarrassing. Being penalised for having insufficient funds in your account is even worse. However, banks...

4 things to consider when buying home insurance

Home is where the heart is, and while you cannot always protect your heart, you can protect yourself from disaster by insuring your home and its contents. But...

Are you underinsured? Here are the dangers

To find that your claim is rejected or underpaid can come as a nasty shock. However, this can be avoided – if you make sure your assets are...

Can you trust payday lenders and loan sharks?

Sometimes payday can seem a century away. It can push you to your limits – and straight into the arms of payday lenders and loan sharks. They can...

Someone crashed into your house – who pays?

Someone crashed into your house. Now what? Besides the trauma, a “dent” in your house can leave a dent in your pocket too. But knowing who is responsible...

Do you need a down payment when buying a house?

It is not uncommon to hear people talking about putting down a sum of money when they purchase a house. Sometimes you question whether your home loan would...

How credit enquiries affect your credit score

Before credit providers lend money to you, they will conduct a credit enquiry on you each time you visit them. This is to determine the level of risk...

Things to consider before lending your car to your family

It is common to let your spouse, child or even siblings drive your car. But not everyone thinks about the implications it has when it comes to insurance....

Do’s and don’ts when you’re over-indebted

Having too much debt can keep you from reaching your financial goals. This is why you need to manage your money wisely to ensure that this does not...

Maximise your retirement savings

We would all love to have a sizeable amount of money when we retire, but not all of us know how to go about it. Saving for your...

How to decide between pay-as-you-go and a contract

It’s time to purchase a new cellphone but you are unsure about whether to choose a pay-as-you-go (PAYG) package or sign a contract. We have put together a...

Why life insurance could be the best gift to your loved ones

There are many ways to show your loved ones you care about them. But who knew that life insurance could be one way of doing this? Purchasing life...

What impact does your credit score have on your insurance?

Your credit score is usually a measure of how likely you are to pay back a loan. Those digits determine whether you will get credit or not. But...

Should you pay your creditors directly while under debt counselling?

Sometimes consumers try to pay their creditors themselves because they’re trying to avoid paying the Payment Distribution Agent (PDA) fees for distribution, says Awie Coetzee, a debt counsellor...

Is your child adequately insured on campus?

When children leave for university, they take their gadgets, bicycles, cars, clothes, and jewellery with them. But we all know that campuses are not always safe, and anything...

Can flatmates share insurance?

You and your flatmate are already sharing a space and certain belongings – so why not share insurance as well? But according to Marius Steyn, personal lines underwriting...

Get life insurance for every stage of your life

Our lives are not static. People grow up, they get married, have children, and retire. So as your life changes, so should your life insurance. Shreekanth Sing, technical...

Do I need to file a tax return?

Folks, it’s that time of the year again… You know, the time of the year when submitting tax returns is on everybody’s mind. The 1st of July marked...

An introduction to alternative investments

Let’s face it, not all of us love the thrill associated with risk taking and enjoying its rewards. In fact, many of us just strive for the simple...

Your pal in payments: the benefits and shortfalls of PayPal

It all began back in 1999 when a small company called Confinity developed a system that sent and received funds electronically. In 2001, the company changed its name...

Financial planning – DIY or use a professional?

Many people turn a blind eye to their finances. They think the subject is very complicated and therefore think it would be good to have a professional financial...

Get old like a rock star with a living annuity

We all dream about that day when we can stop working and start seeing our lifelong savings work for us. And yet, we so often here stories about...

Which bank account is best for you

We all know that access to a bank account is a clever way to manage your money, but with so many different bank accounts available from 11 South...

3 fast facts about transferring your motor warranty policy

When selling your old car, one thing that races through your mind is the transferability of your extended car warranty cover. After all, it increases the price and...

Retirement planning – 7 mistakes to avoid at all costs

You may think you have everything planned and lined up just right when it comes to your retirement. Or you may not have started investing yet, but you’re...

How can I fix my credit report

Your credit report is an important document. It tells the details of your financial status, highlights how much debt you have, your payment history, and any judgements against...

New year, new you – make 2018 the best financial year yet

New Year’s resolutions are so last year… Let’s face it, most people don’t stick to them anyway. Which is why we have resolved to not set ourselves up...

Is a debt consolidation loan the right choice for me?

When you have more loans than friends and you feel your only reason for living is to repay them, debt consolidation may be a way to simplify your...

Relax! There is life after debt review

Knowing what happens after debt review is as important as completing the programme. Being under debt review can feel like a lifetime. After completing the programme there are...

Should you cede your life insurance?

Life insurance guarantees that you are protected in the event that causes income loss. This is the reason you need to think carefully before you cede it to...

Marrying an over-indebted spouse? Protect yourself

Is your soon-to-be spouse over-indebted? Take these steps to not only protect your relationship, but also your credit rating. By Athenkosi Sawutana When people get married, they vow...

Retirement Annuity vs. TFSA

Retirement annuities (RAs) and tax free savings accounts (TFSAs) are two savings vehicles offering people tax benefits. However, their structures differ making them suitable for different savings needs....

Taking care of nice things: How to insure expensive gifts

Insurance is always the last thing on your mind when you receive a gift. Find out which insurances to consider after your thank you speech. Gifts are an...

What you to do when dating someone who’s in debt

You meet your perfect match and you fall in love. However, later you find out that they have debt. Should you continue with the relationship? In a world...

Is an HIV test required for life insurance?

HIV/Aids is treated like any chronic desease nowadays. But does this mean you're no longer required to test before purchasing life insurance? Moneyshop finds out. Previously insurers have...

The other party drove away. What now?

Insurers want you to collect all the evidence to prove your case when you're involved in a car accident. But what happens when the other driver drives off...

Just had a car accident? Here’s how you claim from your insurer

So someone drove into the back of your car. Don't worry. Follow this process to claim from your insurer. With South Africa being one of the most dangerous...

Who pays what in case of a car accident?

Car insurance can help you cover expenses when your car is damaged. See how it can come in handy when you damage another driver's car. Car accidents are...

Is household insurance different from buildings insurance?

Household insurance and buildings insurance are both important because they ensure that you are covered in the event of theft, fire, lightning, storm, wind, or explosion. Here is...

Home insurance: How do I avoid being underinsured?

Underinsurance is very common in South Africa, but you can ensure that you are not part of the statitistics. Ensuring that you are covered in the event of...

Are you insured for safe travels?

Moneyshop looks at two types of insurance that could come in handy while travelling. When you have a trip coming up it is important to prepare for anything...

Can your teen apply for a car finance plan?

Age is one of the factors that will determine whether you qualify for credit or not. By:Athenkosi Sawutana You and your young one are having fun behind the...

Can I apply for car finance for a second-hand car?

The decision to provide credit is based on your credit rating and your affordability. Maybe you’ve just passed your drivers’ licence and you want to perfect your driving...

Could an incontestability clause become applicable in South Africa?

The incontestability clause is not legal in South Africa, but wouldn't it be better if it was introduced? Sometimes consumers lose out on their life insurance claims, either...

Hospital plan vs Medical aid – which one is for me?

By: Athenkosi Sawutana Buying a health plan is one of the things you can do to ensure that you are well taken care of while on your...

6 tips to finance your car

You are in the market for a vehicle, but if it seems daunting to take out a finance plan to buy a car – relax! There are basically...

Which car financing plan is suitable for you?

Before deciding which car finance option is best for you, make sure you know what each entails. By: Athenkosi Sawutana When you apply for credit to buy the...

Should you pay off your credit card with a loan?

A credit card can sometimes feel like a burden, but taking a personal loan to pay it off may not be the best decision. In your effort to...

Take the right steps to ensure your personal loan is approved

Applying for a personal loan is not a difficult task, especially when you have a service like MoneyShop that offers a free and easy way to apply online, however, the problem lies...

No need for a title deed to purchase home contents insurance

Home contents insurance is important even if you don't own a house. By:Athenkosi Sawutana Home contents insurance is usually marketed to people who own houses, which gives the...

This is how your divorce affects debt counselling

No one goes into marriage thinking they will divorce, but divorce happens and affects many aspects of your life. Debt counselling doesn’t only give you and your spouse...

Does life cover exclude certain illnesses?

One of the reasons people purchase life cover is to ensure that they are covered when they are ill and cannot work. When you purchase life insurance, your...

Legal aid or legal insurance – what’s the best option?

The difference between legal aid and legal insurance may not be immediately clear. Life is unpredictable, and that is why you always need to be prepared. You may...

Should you use your home loan to buy a car?

By Athenkosi Sawutana Financing your car with your home loan can have its advantages and disadvantages, hence it is important to speak to your broker before doing it....

Is life cover necessary when you have group risk cover?

Group cover provides financial protection in the event of injury and death , but is it it enough on its own? Many consumers believe that being insured under...

Ensure that your insurance claim is fully paid

Failing to read the terms and conditions in your insurance contract can lead to your claims being rejected. Moneyshop approached Marius Neethling, personal lines underwriting manager at Santam,...

Do you need an alarm to buy home insurance?

Installing a burglar alarm can have many benefits. But how much impact does it have on your home insurance? Many insurance buyers believe that installing a security system...

Dance into the new year without debt

Make sure that you kick-start your year on a high note with these tips. There are only a few days left before we step into the new year...

Can you negotiate grace periods for your repayments?

Certain life events could happen that may demand you to reshuffle your finances, even for just that month. Is this possible and how do you go about this...

Should you borrow from your life insurance?

While life insurance is designed to provide financial assistance in the event of death, it can also come in handy when you are facing an emergency. You have...

How to save while on budget

Often when you ask people about the reasons they don't save, you will hear many interesting stories, including not having money. Saving money when you are on a...

5 tips for a debt-free Christmas

Don't let the festive season leave you swimming in debt. Christmas might be the season to be merry but often it is also the time of bad financial...

Selling a house? You might a need a bridge loan

A bridge loan can help you while you are awaiting the proceeds from the sale of your house. However, it also has a downside. Whether you are selling...

Financial advice for sexagenarians

The 60s can be the scariest time of your life, especially if your finances are not in order. The age of 60 means you have reached many milestones...

Can you take up life insurance after you retire?

Everyone one wants to make sure that their loved ones are taken care of when they are unable to. That is why is many still see value in...

My credit score is good – so why was it denied?

Your credit score may look good, but that doen't mean your loan application will be approved. You have managed to maintain a good credit score; your account payments...

My credit score is good – so why was my loan application rejected?

Your credit score may look good, but that doesn't mean your loan application will be approved. You have managed to maintain a good credit score; your account payments...

Keep your credit card safe on Black Friday!

Black Friday will come and go, but the debt that you will incur will haunt for some time. It’s that time of the year again where we’re going...

Are you abusing your credit card?

Having a credit card is important but make sure you don't abuse it. The second quarter of 2018 saw an increased consumer appetite for credit cards. This facility...

Baby steps to ensure that your children live debt-free

One of the best things that you can do for your children as a parent, is teaching them about debt management. By Athenkosi Sawutana In South Africa, where...

Should you take out a loan for your partner?

Taking out a loan on your partner's behalf is adorable, but before you sign on the dotted lines, make sure you know what you are getting yourself into....

4 Financial products to think about at 40

Your 40s are the most important decade of your life because you are halfway between entering workforce and retirement. This is why you should make sure that these...

What debt collectors are not allowed to do

Knowing what debt collectors can and cannot do can save you a lot of money and headache. Debt collectors usually purchase a book of debtors from creditors and...

Single and childless? You still need life insurance

Single people usually don't need life insurance because no one depends on their income, but there are times when it's necessary to have one. Single people are under...

Curb your debt appetite – only borrow when necessary

This week Moneyshop shows you how to stay out of debt even when it seems impossible. The second quarter of 2018 saw a spike in the number of...

Reasons you don’t see some accounts on your credit report

Ever wondered why you don't see some accounts on your credit report? Moneyshop finds out for you. Despite the National Credit Regulator (NCR) reporting a slight decline in...

Why you pay more for car insurance if you are a man

It is true that men pay more car insurance for different reasons. There are so many factors that influence how much you pay for your car insurance. These...

Tired of being scammed? Here’s how to protect yourself

Many consumers get scammed by their insurers, but you don't have to be one of them. Life insurers deal with fraudulent activities almost every day. Earlier this year,...

3 types of extravagant spenders…which one are you?

Your spending habits are influenced by different factors. However that does not mean that you cannot change them. As much as we need to save money, we also...

5 Financial musts to have during your 20s

Your 20s are the prime time of your life. This is the time you make life changing decisions. Many people start working in their 20s. Unfortunately, not all...

Give your children a head start in life

Making sure that your chidren are taken care of for generations to come takes strategy and effort. Many parents believe that sending their children to school is enough...

Financial interdependence: What newlyweds should know

Financial interdependence is one of the perks that come with being married. When you marry, your spouse becomes your partner and ally, not just your lover. That person...

Why on earth do you want to be frugal?

In a world that promotes consumerism, many people are thriving by spending less and saving more. When the second-richest-person in the world, Warren Buffett, announced that he’s still...

How to get back into financial shape after a divorce

One of the reasons divorce is hard is that people share more than just a bed when they are together. They usually also share their finances. However, divorce...

Should you consider pet insurance?

Pets are not just animals, they are members of the family. Just as you would want to give your children the best care when they are sick, so...

It’s spring time! Let us help clean up your finances

Decluttering is important because it helps you make sense and keep track of your finances. To many people spring is the time to remove all the dirt they...

Exchanging cash with family members? Get a contract

Lending money to a family member is always a complex issue. When it comes to lending money to family, there is always emotion involved. Some people say that...

Debt Mediation: Why you shouldn’t consider it

Why is no one talking about debt mediation? When consumers find themselves unable to pay their monthly debt instalments, they sometimes stumble on unadvisable programmes such as debt...

Debt collection fees: Here’s what you didn’t know

Some South Africans are indebted to the point where they can longer afford the monthly instalments for their debts. Many consumers would rather deal with debt collectors than...

State-funded funeral: local councils come to the rescue of the poor and lonely

Have you ever wondered what will happen to your body when you die if you cannot afford a funeral? Everyone would like to have a decent and dignified...

Emoluments Attachment Order: Here’s what you need to know

Be on top of your debt before creditors garnish your salary. Many South Africans are up to their eyeballs in debt. This has led to them missing their...

5 myths about women and debt – myth 4 will surprise you

We spoke to debt experts to debunk some of the myths surrounding women and debt. Women will shop till they drop … banks are not that keen to...

Your credit report explained

Financial savviness starts with little things such as understanding your credit report. Many consumers are either not educated about their credit reports or reluctant to check them. This...

Avoid funeral insurance scams so you can rest in peace

A lot of people are scammed by unregistered funeral service providers. To ensure that you don’t fall prey, we spoke to Prudence Thepi, general manager at Old Mutual...

Want a raise? Here’s how

You are always the first to arrive at work and the last to leave. However, you feel that the work you put in does not translate into the...

Planning a divorce? Make sure you have these in order

When getting married, you vow to love each other for eternity. But life happens, and you could find yourself heading to the magistrate’s court to terminate the contract....

How to share the same account

You have just moved in with your significant other. One of the things you probably will be managing together is your finances. But while a joint account might...

Take charge of your finances and flourish

The winter chill can easily make you lose focus of your finances. Having to spend double on almost everything: food, electricity, clothes - you can easily veer from...

Credit life insurance explained

Life has so many uncertainties. There is no guarantee that you will still have your job tomorrow. You don’t know if you will still be able to walk...

5 tips To Save On Car Insurance Premiums

Owning a car comes with many expenses. Forget that you're already paying hefty monthly instalments and maintenance fees. You still have to think about how much you need...

Budget Review: As a 20-something – YOU COULD BE SAVING HERE!

June is Youth Month and one of the biggest issues facing the youth of South Africa is debt, whether it be student debt, loans or credit card debt....

Debt after death – is it your responsibility?

You know that your loved one incurred some debts while they were still alive. The house is not paid up. The car that is parked in the garage...

6 things you need to know about a hospital plan

Being admitted to hospital is never a plan, but it happens anyway. However, it is important to ensure that when it happens you are not caught off guard....

Opening a bank account for your child? Check out these 4!

Your child may be too young to know anything about banks or money, but that shouldn’t stop you from instilling financial discipline. One of the ways you can...

Credit facilities – the most popular debt in South Africa

Consumer appetite for credit facilities has increased according to the Credit Market Report (CCMR) published by the National Credit Regulator (NCR) in April. The report showed that there...

Budget Review: As a 20-something where could you be saving?

June is Youth Month and one of the biggest issues facing the youth of South Africa is debt, whether it be student debt, loans or credit card debt....

Loan scams: How to protect yourself from loan scams

The current economic situation we’re experiencing in South Africa has created a strong appetite for credit. Often consumers need to borrow money out of desperation just to help...

Beware of loan sharks

Loan sharks or Mashonisa, as they are known in the South African townships, have caused so much misery in people’s lives. Confiscated possessions and violent threats are just...

Envelope budgeting still relevant in the digital age

In a time where many people find themselves living beyond their means, it has become crucial to create a spending plan. This plan will help you see where...

Do you know the difference between a debit order and a stop order?

The difference between a debit order and a stop order is not obvious to some people. Many use these terms interchangeably without fully understanding their meaning. After all...

8 tips to save for your next holiday trip

Travelling is a sure path to happiness. However, many people put it off because they cannot afford it. We spoke to financial and travel experts to give you...

You can emigrate, but you can’t escape your debt

If you are burdened with debt, you might have considered going overseas and leaving your baggage of debt behind. Some people hope that their debt will then somehow...

Is debt counselling a better alternative to debt consolidation?

The first thing that comes to mind when over indebted and seeking debt relief, is debt consolidation. This eliminates the trouble of dealing with multiple creditors. However, there...

Don’t accept a credit limit increase offer without doing these four things

You have been receiving constant calls from your credit provider, offering to increase your credit limit. You jump for joy thinking of the shopping you could do with...

No will? The law will choose who inherits your assets

Dying without a will, otherwise known as intestacy, is common in South Africa. This is a big mistake as the possessions of the deceased may then be distributed...

Aesthetic cars attract higher premiums

While an expensive, high-performance car like a Ferrari or Aston Martin is a dream come true for some, it can have a negative impact on your insurance premiums....

The price you pay for lying to your insurer

A third of insurance claims have an element of dishonesty according to the South African Insurance Association (SAIA). This happens even though insurance is based on the principle...

What you should know when buying car insurance

Buying a car may be a huge achievement, but it comes with many responsibilities. One of those is ensuring that the car is protected in the event of...

Car loan or home loan – which one should you take first?

Let’s admit it, having your own wheels gives you the freedom to travel wherever you want, whenever you want. You don’t have to stand in queues, waiting for...

Collateral – the main difference between a secured and unsecured loan

Deciding on the type of loan to take normally depends on the circumstances. For instance, when buying a house, one may be spurred to take a secured loan,...

This is how interest rates affect your loan repayments

On 27 March, the South African Reserve Bank (SARB) cut interest rates by 25 basis points. Of course, this was a welcome change to South Africans, who are...

Understanding waiting periods

Everyone who has applied for any insurance in their life is familiar with the term “waiting period.” A term used for the time when consumers can expect no...

The difference between medical aid an medical insurance explained

Many people are often conflicted when choosing their health plans. Sometimes it is because the difference between a medical aid and medical insurance is not clear. To some...

No life insurance without medical exam

When you apply for a life insurance policy, you will probably be required to undergo a medical exam. Although this exam is mostly performed at the insurers’ expense,...

Personal loans not available to new employees

Employment is one of the significant factors when applying for a personal loan. After all, no creditor will lend you money until sure that you have some form...

Psssst! Here is an easy and cheaper way to protect your bond

You have finally saved for the deposit of your dream home. You have spotted the house you want to buy. You have all the required documents. You head...

Bank accounts frozen after you die – what happens to your family?

In the event of death, the bank closes a client’s bank account. This may present many challenges to the family that is left behind as they cannot access...

You can get a criminal record from drinking one beer

Many people land in jail because they are not aware of the legal limits of alcohol. Unfortunately, even a single glass of beer is enough to get you...

How much you spend on your insurance depends on your goals

A survey by Statistics South Africa shows that South Africans spend 8.9 percent of their monthly expenditure on insurance. However, there are still people who overspend on their...

Gender and life insurance

Past claims, not gender, are the cause of the differentiated premiums. In 2012, the European Court of Justice issued a gender directive, prohibiting insurance companies from using gender...

Wrong reasons to take out a personal loan

Taking out a personal loan is a huge, long-term commitment. You shouldn’t make this decision on a whim or take the consequences lightly. “With the current economic conditions,...

WHAT IS GAP COVER?

You may be alarmed when your dentist asks whether you have gap cover. But don’t worry, it’s not what you think! According to Lianne Lutz, wealth coach at...

The consequences of defaulting on your loan

A personal loan may be exactly what you need. But before you jump into the deep end, you should understand the consequences of belly-flopping on the surface and...

Why you may have to pay a late joiner penalty fee

While medical schemes typically won’t refuse you as a new join, they can insist that you pay a late joiner penalty fee. You may be sighing at the...

Why you may have to pay a late joiner penalty fee

While medical schemes typically won’t refuse you as a new join, they can insist that you pay a late joiner penalty fee. You may be sighing at the...

Can i take out a personal loan if i am a foreigner?

According to Standard Bank the short answer is yes. “Banking needs are similar for everyone irrespective of where you live and or study throughout the world,” states Standard...

Taking out a funeral policy for a parent

Losing a loved one is a devastating time in any family and one that should not signal you having to worry about funeral expenses. For this reason, taking...

Getting your personal loan approved

Personal loans are the most popular type of loans because of their versatility, as well as the most despised loans because of their high interest rates. If you...

Can debt consolidated using a credit card

When paying off debt from several accounts, it may be wise to consolidate it into a single account. This assists you in paying off your debt faster by...

Why is debt consolidation not a quick fix

Most credit active consumers think the best way to settle debt is by taking out a consolidation loan. But consolidation loans do not settle debt, they merely group...

5 Common pension mistakes you could be making

Saving for your retirement is important because you want to live out your golden years enjoying life and not worrying about how you can get more money to...

Managing your finances under debt counselling

For many debt counselling is a last resort when their financial life has become unmanageable. Debt counselling helps to keep the debt collectors at bay, and gives you...

Waiting periods for medical schemes

When joining a medical scheme with an existing condition, and if you have never had medical aid cover before (or at least not in the last five years)...

Can you trust robo-advice platforms?

Films and television shows either portray robots as goofy heroes (think C-3PO in Star Wars) or the killer machines with the intention of ending all human life and...

Will my legal insurance cover me if I’m accused of murder?

Legal insurance is often viewed as an unnecessary expense. But should you land in hot water, and find yourself on the wrong side of the law, it could...

How much life insurance does your spouse need?

With the rush of everyday life, people rarely consider what would happen to their spouses if they suddenly passed away. It’s impossible to anticipate when this might happen...