How to: Get insurance quotes from MoneyShop

Ever wondered how you can get insurance quotes from MoneyShop? Follow the steps below, it is simple, quick and easy…

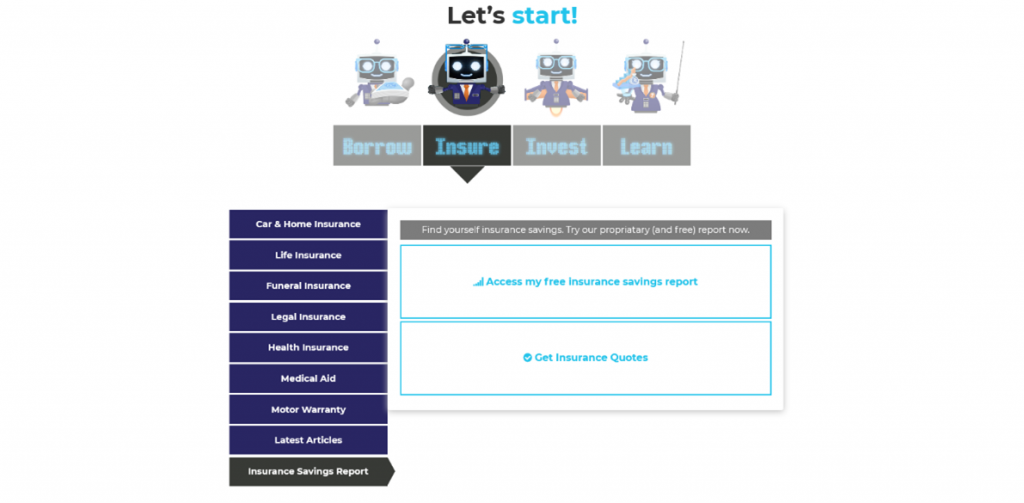

- Go to the Insure tab, click on Insurance Savings Report, click on Get Insurance Quotes.

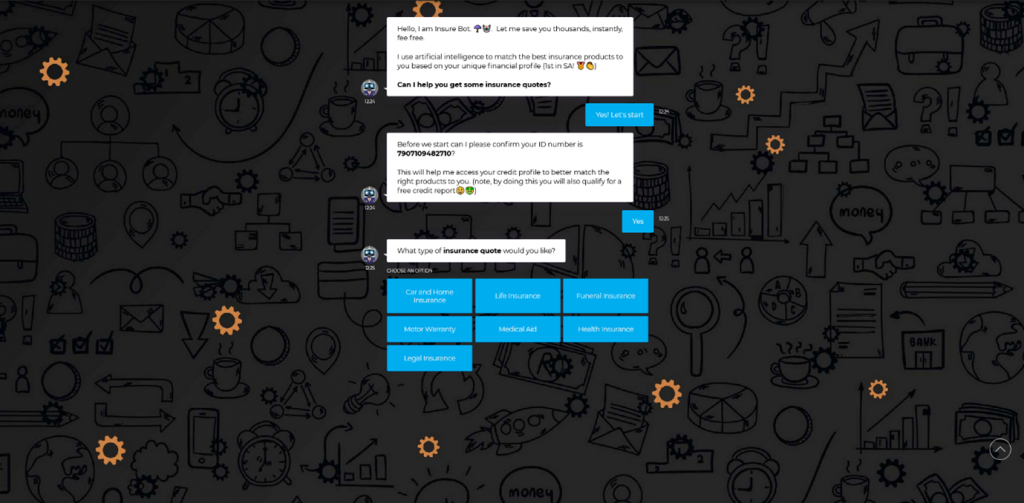

2. Click on Yes! Let’s Start, then confirm or fill in your ID. Number, select the type of insurance you would like a quote on.

3. Follow the prompts thereafter…

MoneyShop, we are here to help

MoneyShop is SA’s largest loan and insurance finding service, helping over 200,000 clients per month.

Using artificial intelligence, we match the right lending, insurance and investment products to the right people at the right time.

What impact does your credit score have on your insurance?

Your credit score is usually a measure of how likely you are to pay back a loan. Those digits determine whether you will get credit or not. However does your credit score have an impact on your insurance?

When you purchase insurance, insurers use a credit-based insurance score to determine your risk category.

What is a credit-based insurance score?

Credit-based insurance scores are attained from a customer’s financial credit history.

A good credit score is an indication of how well a consumer manages his/her finances. And whether someone is more likely to file an insurance claim.

Credit-based insurance scores are not intended to measure creditworthiness, but rather to predict risk.

Insurance scores are generally applied in personal insurance product lines, such as homeowners and vehicle insurance.

Until next time.

The MoneyShop Team

This article has been prepared for information purposes only and it does not constitute legal, financial, or medical advice. The publication, journalist, and companies or individuals providing commentary cannot be held liable in any way. Readers are advised to seek legal, financial, or medical advice where appropriate.

MoneyShop